Features of Co-Pay Health Insurance: It is an amount paid (or a percentage of the total) for certain medical treatments and medication, while under the A part of the expense is taken care of by the insured, and the majority is paid for by the insurer. What is a copay? A copay is a fixed amount you pay for a health care service, usually when you receive the service. The amount can vary by the type of service. How it works: Your plan determines what your copay is for different types of services, and when you have one. Understand Copay, Coinsurance & Deductible with an Example. All three cost-sharing options can be summed up in the table provided below: Suppose a person has a health insurance policy of Rs. With a 10% copay on it and Rs. 5000 deductibles. With the deductible, he further has a.

© TheStreet What is Coinsurance and How Is it Different From Copay?A copay, short for copayment, is a fixed amount a healthcare beneficiary pays for covered medical services. The remaining balance is covered by the person's insurance company. A co-pay is a cash fee that you pay directly to your provider each time you make an appointment. The doctor gets paid every month by your insurance company to manage your care no matter if you go to see him or not. He gets paid a flat monthly fee.

For such an important part of the average American's life, health insurance can get incredibly, frustratingly complicated. Rather than simply having the comfort of knowing you are covered for your medical needs, you're expected to understand a variety of terms in order to know what's covered, how much you're covered for and what you'll have to pay for.

One such term is coinsurance, a vague term without any added context. But coinsurance involves both you and your insurance provider, and so it's important to understand what it is and how it functions in the insurance process. Should you require a medical procedure, knowing your coinsurance can help you get a better approximation of how much you'll have to pay, and where to go from there.

So what is coinsurance, and what separates it from other figures in your health insurance?

What Is Coinsurance?

Coinsurance is the amount you will pay for a medical cost your health insurance covers after your deductible has been met.

Your deductible, if you weren't aware, is the amount you have to pay before insurance kicks in to help pay. In health insurance, your deductible can get spread to multiple costs or one single cost until it runs out. Once you've reached your deductible, that's when insurance comes in. But in healthcare, you also have the coinsurance to deal with.

Coinsurance is measured as a percentage of what you will pay of the remaining costs compared to what insurance will. Perhaps the most common percentages here are 80/20 - that is to say, your provider will pay 80% of it, and you will pay 20%. Another common set up is 70/30 (you pay 30%).

Coinsurance comes into play when your deductible runs out, and depending on your deductible and your medical history, that amount of time could fluctuate wildly. Someone with a history of medical issues may choose a lower deductible plan (though these tend to have higher premiums) because they anticipate future costs, while someone without a troubling history may be more willing to enroll in a high deductible health plan to avoid high premiums, under the assumption that it is unlikely something major will come up.

Does Your Coinsurance Affect Out-of-Pocket Maximums?

Knowing your deductible is crucial for your health insurance, but once you've reached the end of your deductible you should know your out-of-pocket maximum. That is the maximum amount of overall money you have to pay before your insurance company covers all of the costs.

The money you are personally paying when coinsurance gets factored in does, in fact, go toward your out-of-pocket maximum. So let's say you have a deductible of $1,500 and an out-of-pocket maximum of $5,000. You reach that deductible, and the remaining medical costs you owe lead to $300 out of your own pocket due to coinsurance. Combined, this would mean you've paid $1,800 of your $5,000 out-of-pocket maximum.

So while coinsurance can be a bit of a nuisance, more money you have to take from your own pocket put toward medical costs, it is supposed to have a beneficial purpose of bringing you closer to your maximum. How much your out-of-pocket maximum will be will depend on the sort of insurance plan you end up enrolling in.

Example of Coinsurance

Video: How banks actually make money (CNBC)

Let's bring a few figures in to provide a real-life example. Let's say that your healthcare plan has a deductible of $1,000, and you have an 80/20 coinsurance clause.

With this information, say you incur $2,500 in medical costs. Kodak dvc325 software. You haven't had to use your deductible prior to this, so all $1,000 of it goes toward this cost. From there, we're left with $1,500. How much of this will you be paying via the coinsurance clause?

$1,500 x 20% = 1,500 x 0.2 = $300

Your coinsurance payment here would be $300. Combined with your deductible, that means you would be paying $1,300 to the insurance company's $1,200.

This is why understanding your coinsurance clause is crucial. Broadcom_wlan_5603506. You're paying much less than you would without insurance, but in this example you still had to pay for more than half of the costs.

If you end up with other medical costs that your insurance covers, though, your deductible is no longer a factor and you would just have to pay the 20% via your coinsurance clause. So if your next medical costs that year are $1,200, you'd only pay $240 of it.

These, however, may be minor examples compared to what medical expenses you may have to deal with. You still have to reach your out-of-pocket maximum before your insurance company starts to cover 100% of the costs. Generally, your out-of-pocket maximum correlates inversely with your premiums. Much like with deductibles, those with higher premiums have lower maximums and those with lower premiums will likely have higher ones.

Coinsurance vs. Copay

Coinsurance and copay, as similar-sounding terms for your healthcare, may be a little confusing. Though they share similarities, they're ultimately different plans for your insurance.

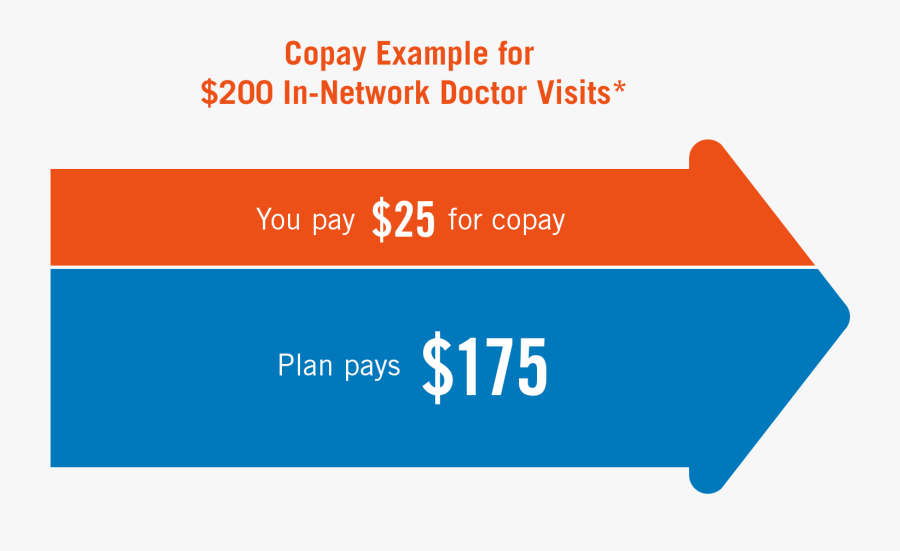

Whereas coinsurance is the percentage you pay for medical costs after your deductible, your copay is a set amount you have to pay for other covered expenses. For example, a prescription medicine can have a copay, as can a physical or other visit to your primary care physician (PCP). Where a coinsurance plan might have you pay 20% for this doctor's visit, a plan with a copay may instead require you to pay a flat fee of $20 while they pay for the rest of it. Depending on the specific figures involved in your specific plan, a copay could be more or less than what the coinsurance is for any given medical cost.

That said, in other ways coinsurance and copay plans are quite similar. Generally copayments, like coinsurance, do not go toward your deductible but do go toward your out-of-pocket maximum.

Coinsurance in Other Insurance Industries

Coinsurance is most prevalent in the health insurance industry. But coinsurance is a way for insurance companies to try and mitigate risk in the event that expenses add up more than they anticipated, so it's not uncommon for you to find coinsurance in other insurance industries as well.

For example, you may find a coinsurance clause when dealing with property insurance. In this industry, the coinsurance dictates that the property must be insured for a percentage of its value. This is particularly common in commercial property.

Much like in health insurance, 80% coinsurance is the most common percentage. Replacement paint brush covers. That meant if you had a $500,000 property, you would need to insure it for, at the very least, $400,000.

Let's say, though, that you didn't do that. You decided to only insure it for $300,000 in an attempt to save money on the deal. This could lead to a costly coinsurance penalty if something goes wrong.

You should have insured it for $400,000 but only went as far as $300,000 to insure your property (and you have a deductible of $2,000). Now let's say a pipe bursts in the building, causing excessive damage that totals up to $200,000. Your insurance will, when reviewing the case, notice you did not get the amount of insurance the coinsurance clause required and will impose a penalty.

To figure out the penalty, your insurance will divide the amount of insurance you got by how much you were supposed to (in this case, 300,000/400,000 or 0.75) and multiply that by your damage. 200,000 x .75 = $150,000, which is how much your insurance will pay. Thus, here your coinsurance penalty is a whopping $50,000.

This article was originally published by TheStreet.Posted on Jun, 2020

This article was originally published by TheStreet.Posted on Jun, 2020Co-pay in health insurance refers to an arrangement between the insurance company and the insured. As per this agreement, policyholders have to pay a part of the medical expenses on their own, while the insurance company pays the remaining amount. Co-pay is applicable when you choose a health insurance policy with a co-pay clause. Here’s all you need to know about co-pay.

Why do insurance companies use the co-pay clause?

The co-pay clause is designed for the benefit of both the insurance provider and the insured. There are several legitimate reasons why many insurance companies include the co-pay clause in their health insurance policies. Listed below are some of them:

- The co-pay clause ensures that the insured party exercises judiciousness while filing a claim. Filing claims for unnecessary reasons can affect the premium payable when the policy is renewed. As such, the clause enables the insured to decide whether a claim is worth filing. By not filing an unnecessary insurance claim, the policyholder becomes eligible for discounts on premiums.

- The cost of treatment has been increasing with every passing year. If you decide to seek treatment in an expensive hospital, you may end up exhausting your sum assured. This in turn can increase your premium amount when you renew the policy. The co-pay clause ensures that policyholders do not compromise on treatment, but are, at the same time, mindful of the costs they would have to bear, for seeking expensive treatment.

- With the co-pay clause, the idea is to discourage wasteful expenditure for both the insured and the insurer. Since the co-pay clause requires policyholders to also contribute, they can determine whether it makes sense to opt for expensive healthcare as compared to quality healthcare.

- Co-pay affords a sense of awareness and ownership to the insured parties since they too have to bear a portion of the medical expenses.

Example to help understand co-pay

Let’s say your health insurance policy has a co-pay clause of 10%. Now, you have encashed your insurance policy, and the total medical expense amounts to ₹50,000. In such a case you need to pay 10%, i.e. ₹5,000 from your own pocket. Your insurance provider will bear the remaining amount of ₹45,000.

Features of co-payment

Before you decide to choose a policy with the co-pay clause, you need to understand its various features and how they would be applicable to you. Here are the general features

- Only a small, partial amount has to be paid by the policyholder. The insurance company will pay for the rest

- Co-pay clause applies to medical services, including hospitalization, doctor’s fees, lab tests, cost of medicines, etc.

- Health insurance plans with a higher premium amount generally have a lower co-payment percentage

- The main objective of the co-pay clause in health insurance is to save costs and discourage unnecessary claims

- Co-pay is mostly applicable to health insurance policies for senior citizens

Difference between co-pay and deductible

Meaning Of Copay Insurance Meaning

Most people seem to confuse co-pay with deductibles. Co-pay simply means that you must pay a specified, pre-determined portion or percentage of the medical expenses. On the other hand, the deductible is the amount you pay before the insurance provider pays for the costs incurred. Essentially, insurance providers are liable to pay the amounts exceeding the deductible. For instance, if the deductible is ₹25,000 and you file a claim of ₹60,000, the insurer is liable to pay only ₹35,000.

How to choose the right health insurance with co-pay?

Apart from knowing what a co-pay clause does, there are some other essential things you need to know to choose the right health insurance policy

Co-pay percentage

The co-pay percentage is the cost that the policyholder will have to pay from the total medical bill. Before buying a health insurance policy with a co-pay clause, ensure that you check and understand the co-pay percentage as this will be the amount you pay from your pocket.

Premiums

Usually, policies with a co-pay clause have a lower premium as compared to other policies. As such, health plans with the co-pay clause can facilitate a lot of savings on insurance premiums.

Opting for co-pay – should you do it or not

Your health insurance policy covers you against more than just hospital bills. Apart from serving as a safety net in your hour of need, it covers you against several other expenses including doctor/surgeon fees, medical reports, and ambulance charges and so on. While choosing an insurance policy, you can decide whether or not to opt for the co-pay option. The answer to this is simple; people who are young and healthy and not suffering from any pre-existing diseases can benefit from opting for co-pay, as it can enable significant savings. With the co-pay clause, such people will not need to encash their entire insurance policy, while they can avail the many benefits that go with it.

Copay In Insurance Meaning In Hindi

While buying your insurance policy, reach out to us at Pinc Insurance to know more about the co-pay option. We provide in-depth insurance guidance, including assistance in purchasing policies and filing claims.